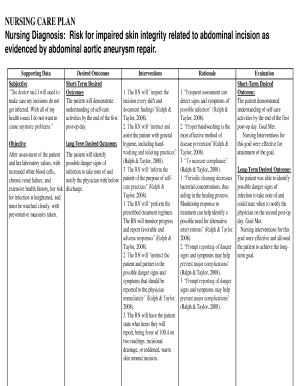

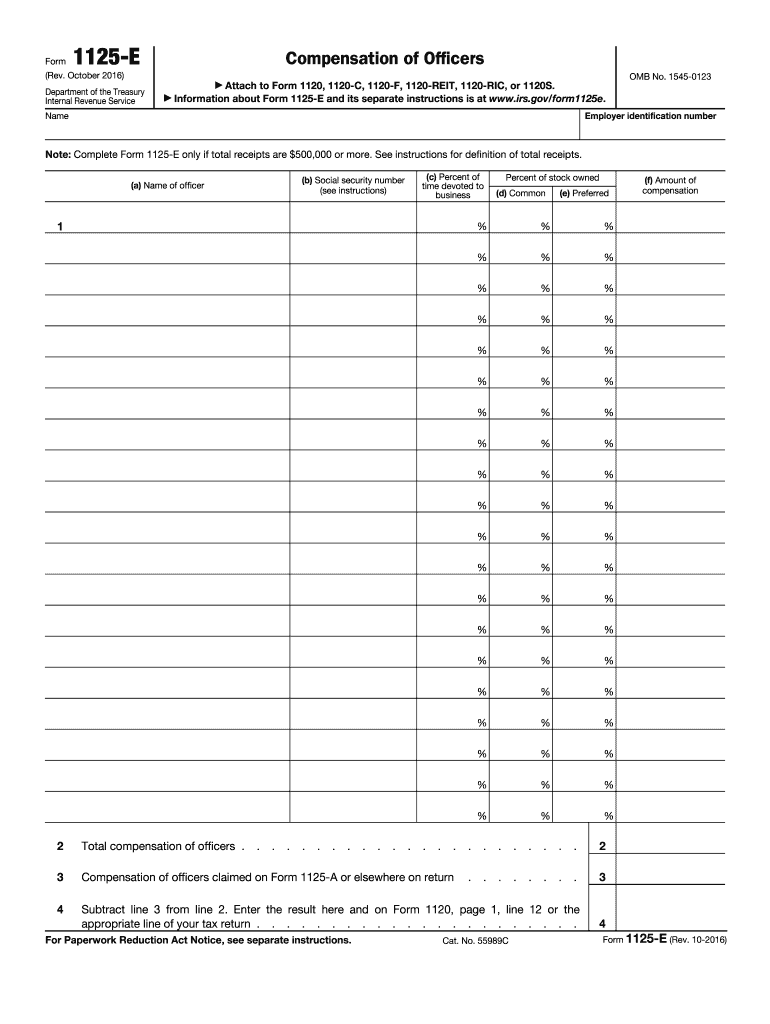

IRS 1125-E 2016-2026 free printable template

Instructions and Help about IRS 1125-E

How to edit IRS 1125-E

How to fill out IRS 1125-E

Latest updates to IRS 1125-E

All You Need to Know About IRS 1125-E

What is IRS 1125-E?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1125-E

What should I do if I discover an error on my IRS 1125-E after submission?

If you realize there's an error on your IRS 1125-E post-filing, you should file an amended return using the same form. Be sure to clearly indicate the corrections made. Keeping thorough records of the original and amended forms is also advisable to ensure proper processing.

How can I check the status of my IRS 1125-E submission?

To verify the status of your IRS 1125-E, you can check with the IRS e-file status tool online or contact the IRS directly. Be prepared to provide relevant details such as your name, taxpayer identification number, and submission date to facilitate the process.

What are the most common errors encountered when filing IRS 1125-E?

Common errors when filing IRS 1125-E include incorrect taxpayer identification numbers, mismatched names, and missing required fields. To avoid these issues, double-check the information for accuracy before submission and ensure all sections are fully completed.

What happens if my e-filed IRS 1125-E is rejected?

If your e-filed IRS 1125-E is rejected, the IRS will typically send you a notification detailing the reason for the rejection. You will need to correct the identified issues and resubmit the form promptly to avoid any penalties or delays.